What started as opportunistic scams has become a global industry, and AI is about to industrialize deception itself.

In October 2025, Myanmar’s military raided a compound known as KK Park: a barbed wire-ringed complex of more than 250 low-rise buildings bristling with Starlink satellite dishes, complete with supermarkets, dormitories, and a clinic. Inside was a coordinated fraud factory: as many as 20,000 people coerced into 17-hour shifts running romance scams and fake crypto investments. Two blockchain addresses linked to the Chinese‐run operation received over $100M in stablecoin transfers from victims mostly in the developed world.

KK Park represents the apogee of industrial-scale fraud: a vast physical undertaking built on global telecommunications, sustained by the liminal spaces of failed states, and supercharged by cryptocurrency. AI is already making this factory model obsolete. As the world’s payment infrastructure shifts onto stablecoin rails, the attack surface for this new, borderless economy of fraud will expand to every wallet and transaction on the planet.

Anthropic, the creator of the Claude large language model, published results of a study earlier this month that uncovered $4.6M in simulated smart contract exploits in what it claimed was "a proof-of-concept that profitable, real-world autonomous exploitation is technically feasible." Fraud is also entering its AI phase. What once required compounds, call-center labor, and coercion is now becoming autonomous code:

These aren’t future threats. Reports of AI-powered crypto scams surged 456% in the year to April 2025, according to Chainabuse. From a deepfake of Elon Musk on a fake SpaceX stream promising to double your crypto if you scan a QR code to AI chatbots powering romance scams. The infrastructure that once relied on trafficked labor and physical compounds can now live entirely in the cloud.

This industrialization of fraud and the advent of scams run like a global, scaled enterprise is no longer a localized consumer annoyance; it presents a profound systemic and financial crisis for centralized exchanges, payment providers, and financial institutions operating in Web3.

The consequences begin with a potential reputational crisis and platform liability. Every user loss due to a protracted pig butchering or investment scam erodes confidence in a platform's core security promise. When victims willingly withdraw funds to a scammer, their immediate reaction is to blame the exchange or institution for failing to protect them. This leads directly to user churn, regulatory scrutiny, and severely damages the trust necessary for sustainable growth.

Accordingly, this damage is then compounded by direct financial and operational risk. Coordinated fraud clusters operating on platforms generate enormous financial exposure. This exposure includes liability for push payment fraud (APP Fraud), chargebacks related to on-ramp scams (credit card theft), and the immense operational burden of manually investigating complex, multi-hop transactions that span thousands of addresses. Without automated controls, your fraud teams are overwhelmed, fighting a digital army with analog tools.

Finally, traditional, reactive screening tools, which focus on basic blocklists or compliance issues, can now easily fall victim to evolving blind spots in their detection capabilities. They are fundamentally incapable of recognizing the behavioral patterns that define these new social engineering scams. The methodical nature of withdrawal fraud requires an equally adaptive, predictive defense that can identify a scammer based on their network behavior, not just a static, publicly reported address.

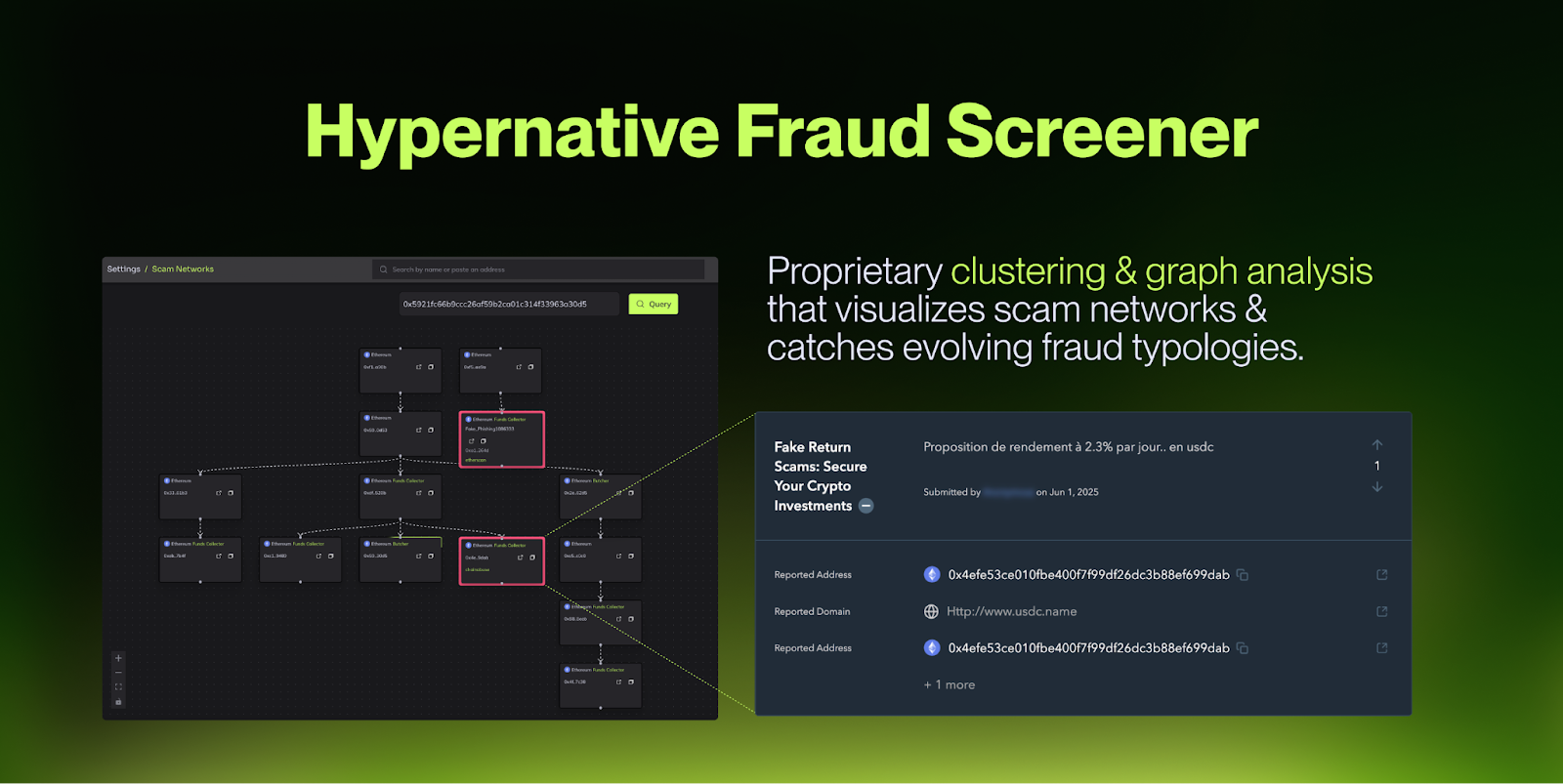

Fighting an industrialized problem requires an industrialized, predictive solution. Hypernative's Fraud Prevention solution moves beyond static blacklisting and transactional simulation to provide critical real-time intelligence at the point of withdrawal, delivering three layers of proactive defense:

The challenge for institutions is no longer to detect fraud after the fact, but to build immunity into the transaction layer itself. Hypernative makes that possible by turning the rails of Web3 from a vulnerability into a defense system that operates at machine speed.

Reach out for a demo of Hypernative’s solutions, tune into Hypernative’s blog and our social channels to keep up with the latest on cybersecurity in Web3.

Secure everything you build, run and own in Web3 with Hypernative.

Website | X (Twitter) | LinkedIn